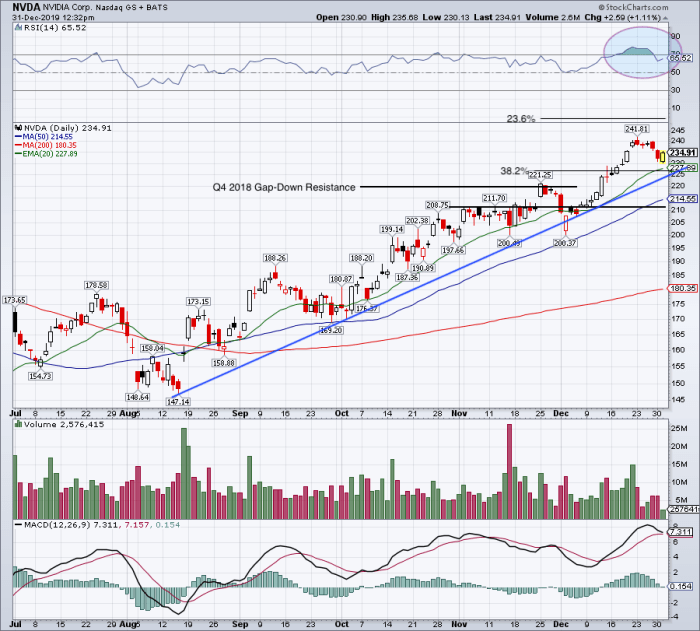

The biggest question for prospective NVDA stock investors is whether to buy now. Another risk we’re becoming all-too aware of in 2021 is a global shortage of semiconductors – Nvidia is not immune. And Nvidia’s other lines of business, including gaming, data centers, and AI are on fire, so that will help to reduce the sting should crypto falter. A loss of revenue should miners hit pause would be painful, but the company is unlikely to end up with a glut of unsold graphics cards as a result, as it did in 2018. That being said, Nvidia is managing the crypto mining aspect of its business more closely this time around. Nvidia shares lost nearly half their value in just two months. Investors still grimace at the beating NVDA stock took in late 2018 when that exact scenario happened. When cryptocurrencies tank, people stop buying graphics cards for crypto mining. For one thing, we all know that cryptocurrency can be extremely volatile.

There are some risks inherent in this Portfolio Grader “B” rated stock. Whether you buy now, or wait for the individual share price to become more affordable post-stock split, an investment in Nvidia is very likely to deliver long-term growth. Shareholders of record as of June 21 will each receive three additional shares of NVDA stock after the market closes on July 19. That plan was approved by Nvidia stockholders on June 3. The company proposed a four-for-one stock split, aiming to make shares more accessible to both investors and employees. Stock Split Announced and Approvedīesides the record financial performance, Nvidia had other big news for investors in May. NVDA stock is up 10% in the two weeks since those impressive results. The company also issued Q2 guidance for revenue of $6.3 billion, plus or minus 2%.

0 kommentar(er)

0 kommentar(er)